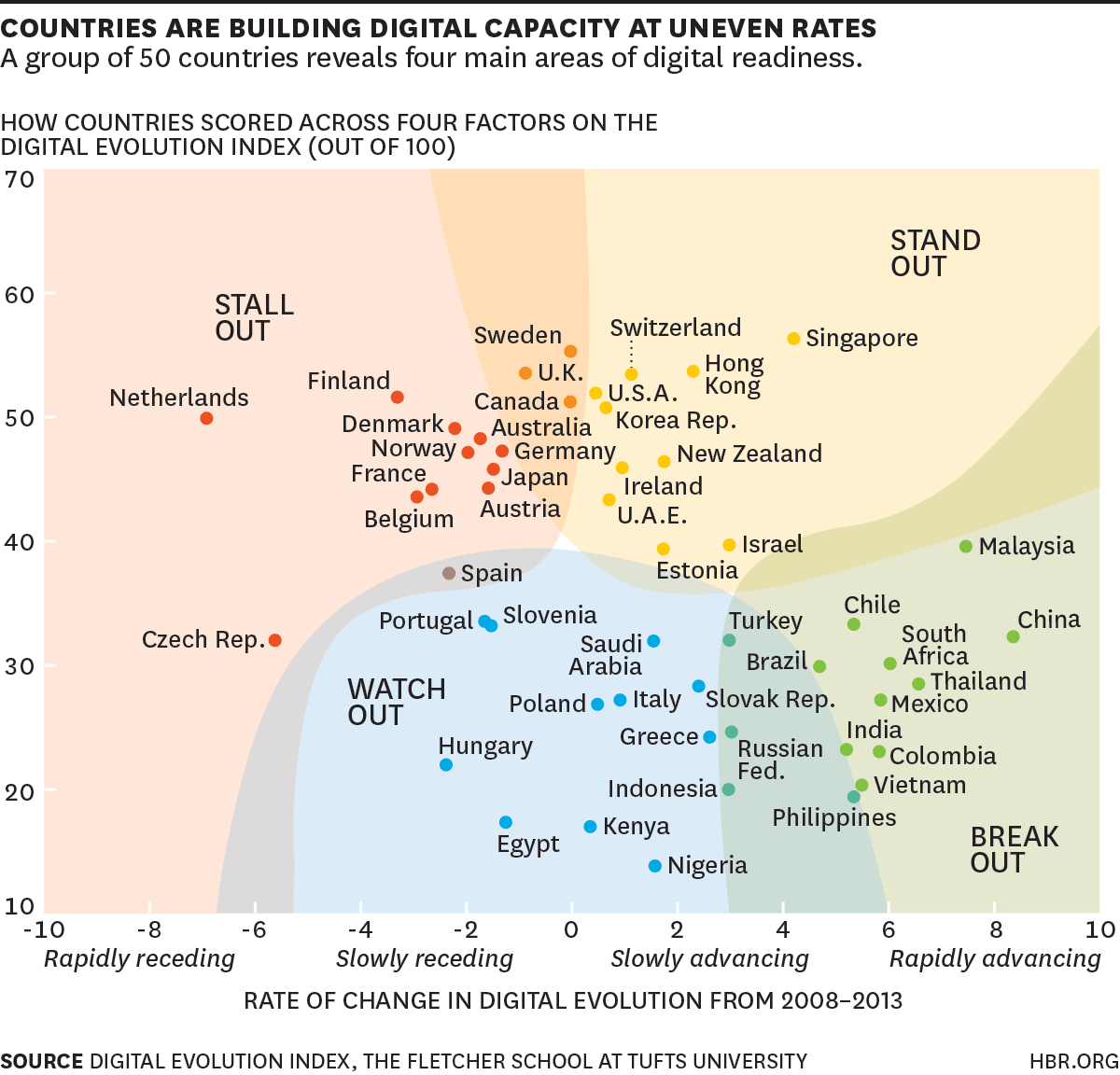

Like weather created by uneven heating of the earth’s surface, perhaps national economies can be forecast on their digital capacity. Harvard Business Review printed their prognosis for how the electrons roll. The results are a lovely swirl of countries huddled in a neutral center, perhaps suggesting any country could slide into a more or less desirable zone at any time.

As part of our research, we wanted to understand who was changing quickly to prepare for the digital marketplace and who wasn’t.

Where the Digital Economy Is Moving the Fastest

- Stand Out countries have shown high levels of digital development in the past and continue to remain on an upward trajectory.

- Stall Out countries have achieved a high level of evolution in the past but are losing momentum and risk falling behind.

- Break Out countries have the potential to develop strong digital economies. Though their overall score is still low, they are moving upward and are poised to become Stand Out countries in the future.

- Watch Out countries face significant opportunities and challenges, with low scores on both current level and upward motion of their DEI. Some may be able to overcome limitations with clever innovations and stopgap measures, while others seem to be stuck.

Not so surprisingly, the BRICS countries all gather in the BREAK OUT quadrant, with Russia perhaps loitering a bit too closely to WATCH OUT. Interestingly, a string of European countries occupy STALL OUT. It would’ve been more interesting had they lined up geographically for the portrait. Relative to the other zones, the STAND OUT grouping is quite the republic of representatives.

Our Digital Evolution Index (DEI), created by the Fletcher School at Tufts University (with support from Mastercard and DataCash), is derived from four broad drivers: supply-side factors (including access, fulfillment, and transactions infrastructure); demand-side factors (including consumer behaviors and trends, financial and Internet and social media savviness); innovations (including the entrepreneurial, technological and funding ecosystems, presence and extent of disruptive forces and the presence of a start-up culture and mindset); and institutions (including government effectiveness and its role in business, laws and regulations and promoting the digital ecosystem). The resulting index includes a ranking of 50 countries, which were chosen because they are either home to most of the current 3 billion internet users or they are where the next billion users are likely to come from.

The stinger behind the research though is that the digital future has a significant twist. The Information Age began on desktops and moved to other devices. It’s destiny – for the next seismic event – will be held in the hand of a billion people in areas remote and unseen to date.

What does the future hold? The next billion consumers to come online will be making their digital decisions on a mobile device – very different from the practices of the first billion that helped build many of the foundations of the current e-commerce industry.